Beware of Fake Tax Refund Messages: IT Department Issued An Immediate Warning

Beware of Fake Tax Refund Messages: IT Department Issued An Immediate Warning

The Income Tax Department has issued a critical advisory, cautioning taxpayers to exercise caution in the face of an increasing number of fraudulent schemes that are designed to defraud them of their income tax refunds. Scammers are utilizing a variety of methods, such as phishing emails and phony messages, to trick individuals into disclosing sensitive information, resulting in significant financial losses.

The Department of Income Tax has lately issued a strong warning to taxpayers all throughout the country, drawing attention to the growing number of instances of fraudulent attempts to obtain refunds of income taxes. Fraudsters are employing a wide range of deceptive strategies in order to trick those who are not paying attention into divulging their personal and financial information.

These scams have become increasingly sophisticated in recent years. This recommendation from the department serves as an important reminder to taxpayers that they should exercise caution and continue to be vigilant regarding the risks that are posed by these fraudulent financial schemes.

How the Scam Operates?

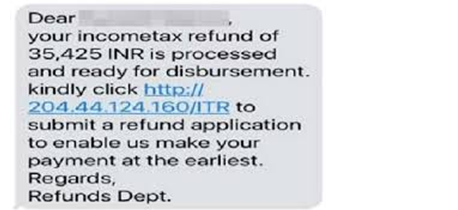

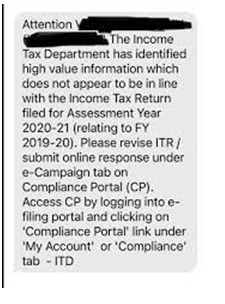

Scammers will often send out mass emails, text messages, or even phone calls to individuals, saying that the recipient is qualified to get a tax refund. It is common for these emails to have an official appearance since they make use of the name and emblem of the Income Tax Department in order to lend credibility to their fraudulent claims.

After that, the con artists either take the victim to a phony website or ask them to click on a link that asks them to enter sensitive information such as their credit card numbers, bank account data, or other sensitive information.

In a recent incident that was brought to the attention of the department, a victim lost Rs 1.5 lakh after clicking on a fraudulent reimbursement message. The man was led to a bogus app, which then proceeded to hack his phone, which ultimately resulted in unlawful withdrawals from his bank account. These cons can result in enormous financial losses, and this particular instance is only one example of how they can do so.

Recognizing the Red Flags

In order to prevent taxpayers from falling prey to these cons, the Department of Income Tax has listed many warning indicators that taxpayers should be aware of, including the following:

1. Communication That Is Not Requested

Be suspicious of any unsolicited communication, whether it be an email, a text message, or a phone call, that claims you are qualified to get a tax refund. Under no circumstances will the department make a request for personal information through these methods.

2. Suspicious Links and Attachments

Fraudsters frequently include their messages with links or attachments that lead to phishing websites or downloading harmful software onto your device. These links and attachments are a common form of communication. Under no circumstances should you ever open any attachments or click on any of these links that come from unknown sources.

3. Urgency and Pressure

Con artists may try to instill a sense of urgency in their victims by asserting that they must take immediate action in order to receive their reimbursement. For the purpose of preventing you from engaging in critical thought regarding the legitimacy of the request, this pressure is being maintained.

4. Requests for Sensitive Information

The Income Tax Department will never ask you to disclose your credit card numbers, bank account information, or any other sensitive information over the phone, send you an email, or send you a text message.

Methods to Ensure Your Own Safety:

For the purpose of assisting taxpayers in protecting themselves from these scams, the Income Tax Department has established a number of guidelines, which are as follows:

- Do Not Respond: If you receive a call or message that seems questionable, you should not contact the person. It is possible that interacting with the sender will result in additional issues.

- Avoid Clicking Links: When receiving unsolicited emails or texts, you should never click on any links that are included in them. Instead, if you need to verify the status of your refund, you should go straight to the official website managed by the Income Tax Department.

- Verify Communications: It is important to authenticate communications before taking any action. If you are unsure about the validity of a communication, you should check it through official means.

- Maintain Existing Safety Precautions: Make certain that both your computer and your smartphone are protected by a firewall and that they have the most recent version of anti-virus software installed. In order to protect yourself from harmful attacks, you should regularly update your equipment.

Reporting Fraudulent Activities

In the event that you come across fraudulent activity or receive a message that seems questionable, the Income Tax Department strongly encourages you to communicate this information as soon as possible. If you want to submit a copy of the email or website URL to incident@cert-in.org.in, you may also forward it to webmanager@incometax.gov.in. Two choices are available to you when you are forwarding the email:

- Send the message in the same format as you received it.

- Make sure to include the Internet header of the email, which stores additional information that can be used to identify the originator of the message.

Your inbox should be cleared of the bogus message once you have reported the occurrence. This will prevent any further risks from occurring. Maintaining vigilance against fraudulent schemes involving income tax refunds is absolutely necessary as tax season draws near. When it comes to dealing with unwanted communications, the warning issued by the Income Tax Department serves as a timely reminder of the importance of exercising caution.

It is possible for taxpayers to defend themselves from falling prey to fraudulent schemes by identifying the warning signs and adhering to the rules provided by the department. Maintain your knowledge, take precautions to protect yourself, and make sure to check the legitimacy of any message that purports to originate from the Internal Revenue Service.

About The Author:

Yogesh Naager is a content marketer who specializes in the cybersecurity and B2B space. Besides writing for the News4Hackers blogs, he also writes for brands including Craw Security, Bytecode Security, and NASSCOM.

READ MORE ARTICLE HERE